Here’s why you should be investing any extra savings

Money… they say it makes the world go round.

When you consider the state of the economy in recent years, it’s fair to say that ‘they’ are 100% right on the money (at least where that expression is concerned).

However, when it comes to your own cash flow, how purposeful are you actually being?

Are you spending according to a preset budget? Are you putting savings aside for a rainy day?

The answers most likely depend on where you are on the pay grid or what your pension income looks like in retirement. After all, money is what money does. The more you have of it, the more you can afford to put some of that money away (at least that should be the ultimate goal).

But savings, like people, shouldn’t just sit around—they need to be put to work.

And if you want those savings to work hard, we totally recommend investing that money—and here are 3 reasons why:

1. Money that simply ‘sits’ loses value, fast.

If you run your personal budget according to the philosophy that ‘a loonie in the hand is worth two in the bush’, we’re sorry to say the longer you hold on to that loonie, the less it’ll be worth over time.

But that’s inflation for you.

Like gravity for money, inflation is a slow and steady force that makes costs go up and the value of cash assets go down. When your loonies are invested in a diversified portfolio, they have the potential to outpace inflation. Positive returns, compounded over a long period of time, can have a significant impact on your portfolio.

2. If you’re early in your education career, now is the perfect time to start investing for the long-term.

While you most likely have your retirement needs covered (if you’re paying into OTPP/OMERS), there are other goals to be striving and saving for.

Buying a house. Having kids. Sending said kids to college or university. Life isn’t cheap, no matter where on the pay grid you happen to be. Investing your extra savings will put you on a steady path to achieving whatever goals you’re working towards.

And it doesn’t take a lot of money to get you started.

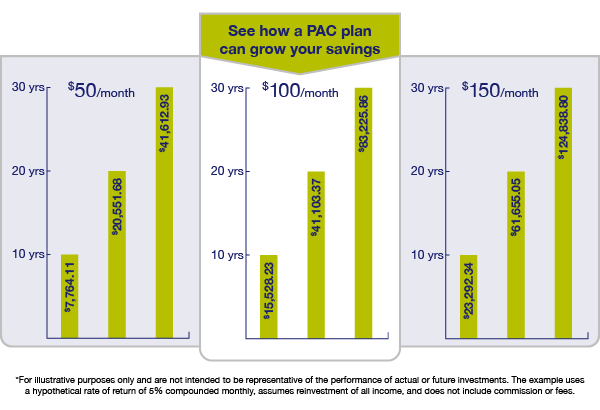

For example, let’s say you began your investment journey by setting up regular pre-authorized contributions in the amount of $50 a month. After 10 years, you’d be looking at close to $8,000—all for just $1.66 a day.

As you can see from the above illustration, compounded returns are more significant the more (and longer) you contribute. That’s the benefit of planning for the long-term.

Naturally, the sooner you start investing, the more of a nest egg you’ll have for the future.

Tip: One of the perks of setting up a PAC (pre-authorized contributions) is benefitting from dollar cost averaging. It’s a very useful technique that can lower investment costs and reduce the impact of market volatility on your portfolio. Here are 7 ways to make the most of this super smart strategy.

3. While there’s no predicting the future, history has shown that investing really does pay off.

If you’re a little hesitant to invest because of the dreaded ‘v’ word (volatility), it’s important to remember that ups and downs are completely normal where the market is concerned. Yet despite the occasional crashes and pullbacks through the years, overall stocks have steadily risen.

You only have to look at the last 100 years for proof of this.

$1 invested in small cap stocks in the 1920s, for example, would be worth nearly $40,000 today.

That’s the power of time and the market.

Naturally your time horizon (for investing) won’t be a century, but the premise is the same. Investing whatever disposable income you have now will earn you far more in the long run than simply letting it sit in your pocket/savings account. Or worse. Spending that money on something you really don’t need.

When it comes to setting up the right investment strategy for your extra savings, be sure to reach out to Educators Financial Group, first.

We’ve been helping education members to navigate their investment portfolios through many changing times over the years. So regardless of where you are in your career, what your present financial situation is like, or what the future may hold—we’ll make sure you’re equipped with the information and resources you need to invest with confidence.