A change in the curriculum: what CPP changes could mean to you.

After discussing revisions to the Canada Pension Plan (CPP) since 2009, Ottawa and eight of 10 provinces have reached agreement to expand the CPP.

Why the change to the Plan? “You can blame the decrease in corporate pensions in recent years”, says Graham Walker, Senior Financial Advisor. “This, in turn, is causing a shortfall in middle-income retirement planning”. Middle-income workers under the age of 45 making about $50,000 to $80,000 a year are most at risk. Without the defined-benefit pensions that were more common in the past, it is thought that many could hit retirement with little in savings. “Even with the pensions that education members receive, they need to be aware of how much to expect with CPP, to help with their planning for retirement”, says Graham.

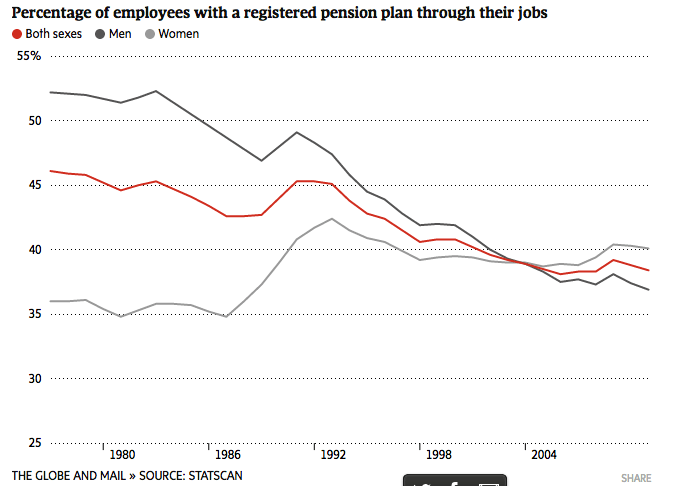

The chart below shows the change in percentage of employees with a registered pension plan through their jobs between 1971 and 2011. With an increasing number of employees without registered pension plan coverage – including some education members and their partners – many of you will be impacted.

The Globe and Mail explains it like this: In 2016, Canadian workers and employers each paid 4.95% of their salaries into the CPP, to a maximum income level of $54,900 a year, and upon retirement at 65, employees are paid a maximum of $13,370. Education members who earned more than $54,900 did not contribute to CPP above that level, and do not earn any additional pension benefit.

Here’s how you could be affected by the changes to CPP:

- The annual payout target has increased, from about 25% of pre-retirement earnings to 33%. So, using 2016 figures, education members who earned $54,900 would receive a maximum annual pension upon retirement of $17,500 – an increase of about $4,390 a year.

- Secondly, the maximum income covered by CPP will increase from $54,900 in 2016 to $82,700 by 2025 … so education members earning the higher amount will be eligible to earn CPP benefits on a larger portion of their income. For example, if you made $82,700, your CPP benefits will rise to a maximum of about $19,900 a year in 2016 dollars.

You’ll contribute a bit more…

Contributions from employees and employers will increase by 1%, to be phased in from 2019 to 2023. If you’re earning at least the maximum salary cap (which will be $60,200 in 2019, and slightly higher each subsequent year) you can expect to see between $7.50 to $56 more taken off your paycheque each month.

…and you will get a little (or a lot) more when you retire.

The real ‘winners’ of the CPP changes – education members who will see the most increase from the Plan – are those just entering the workplace. Those with around 10 years to go until retirement are less lucky. They’ll have to contribute significantly more, while receiving just 12% in additional CPP per year.

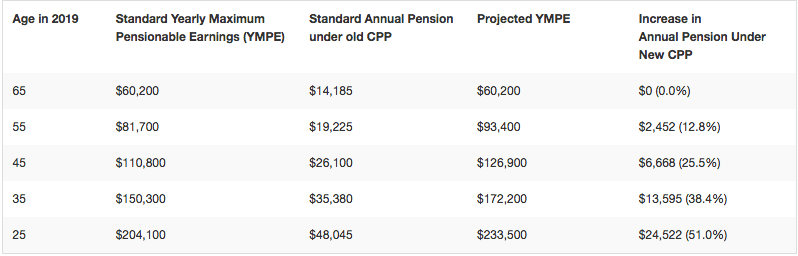

The following chart** is based on projections of what the yearly maximum cap will be.

The chart above suggests that a 25-year-old, who is 40 years away from retirement in 2019, and eligible for the maximum benefit amount, would reap the most rewards of the fully expanded regime. They would receive around 51% more in yearly payouts by the time they turn 65 compared to the current plan.

New service standards for CPP applicants with terminal illness, and others.

In an effort to recognize the urgency to the processing of applications, and to provide decisions faster, the federal government is adding welcomed standards for applications involving terminal illness or grave medical conditions, and updating standards for general applicants and those who submit reconsideration requests. These include:

- Applications involving terminal illness: making a decision within 5 business days of receiving a complete application

- Applications involving grave medical conditions. making a decision within 30 calendar days of receiving a complete application

- Applications regarding general applicants: making a decision within 120 days of receiving a complete application

- Applications requesting benefits reconsideration: making a decision within 120 days of receiving a complete application

For more information, go here.

Understand your sources of retirement income.

Like most people, your retirement income will come from several sources – your education pension, Old Age Security (OAS), your personal savings (both registered plans as well as and non-registered savings and investments), as well as CPP.

Your retirement planning is a crucial part of your financial plan and future security.

To make sure you understand how the recent changes to CPP impact you, speak to an Educators Financial Group financial specialist today.

Disclaimer: Figures quoted were accurate at time of writing, and may change over time.

Sources:

http://www.moneysense.ca/save/retirement/pensions/this-is-how-much-youll-get-from-the-cpp-changes/

** Morneau Sheppell