Investing 101: how to weather the storm during a recession

Escape velocity aside, what goes up must eventually come down.

After all, there’s no escaping basic gravity.

But what do you do if you have money in the market and the economy ends up taking a massive downturn to the point of a recession? Should you simply keep calm and carry on?

“Well yes and no,” says Educators Certified Financial Planner Lisa Raponi.

Lisa goes on to clarify, “Investors should always keep a level head, regardless of market conditions. However, recessions are an entirely different beast because they tend to bring about an extreme amount of volatility. So, while keeping calm is definitely crucial, carrying on with your existing plan doesn’t necessarily mean that you should do nothing.”

Instead, Lisa recommends shifting to more of a ‘keep calm and be proactive’ approach ahead of a possible recession.

“This means doing a bit of housekeeping where your portfolio is concerned,” continues Lisa. “Naturally there’s no predicting as to when a recession will hit or how long it will last, but remember that investing is more about time in the market versus timing the market. As long as your portfolio is well-balanced, you should be positioned to weather the storm.”

Is there a difference between how education members should plan for a recession based on how close they are to retirement?

“For those with a stable income, a recession should be less of a concern, regardless of how far or close you are to retirement,” explains Lisa. “If it’s any consolation, consider that portfolios aren’t supposed to move in a straight, uphill line to begin with. Fluctuations along the way are normal. Think of a wavy line going uphill rather than a straight line going uphill. It might just take a little longer to get up that hill. If your portfolio is well-diversified and you are realistic about your risk tolerance, you should be fine to weather the storm.”

When it comes to risk tolerance and recessions, Lisa has a very important piece of advice.

“Avoid the temptation to lower your risk tolerance during a recession, as this can lead to locking in losses. Any losses will of course only materialize if you sell—and changing your risk tolerance could lead you to selling off your portfolio in a state of panic. Your risk tolerance should represent your general attitude towards volatility in both good and bad times, so if you’re finding yourself losing sleep and considering selling during bad times, you may need to re-evaluate your risk tolerance with your financial advisor.”

If you’re new to—or are on the fence about investing (on the cusp of a recession), here are a few tips:

- If you’re investing for the long-term, can stomach a bit of risk, and have a preference toward equities, buying low (during a recession) could be a solid strategy

- If you are more risk-averse, consider taking a balanced approach by incorporating some fixed-income, high-interest savings, or even liquid money market funds into your portfolio

- Money market funds or high interest savings accounts might be a good place to ‘park’ your money while you wait for a less volatile time; however, be aware that you might end up with a return that is less than the rate of inflation

- As interest rates rise, GICs could also be an attractive option

Then there’s the matter of withdrawing from your investments during a recession.

“Withdrawals should be based on your time horizon,” says Lisa. “If you don’t need the money for the foreseeable future, then avoid withdrawing from your portfolio, as this could have adverse tax effects—in addition to materializing any financial losses. With that said, your portfolio should still be positioned to handle short-term withdrawals while still maintaining opportunities for growth. If you’re approaching retirement, chances are you’ve been preparing your portfolio for your pension years for some time. Since you most likely won’t need 100% of your retirement income at once, I would recommend speaking to a financial advisor about the best way to withdraw those funds.”

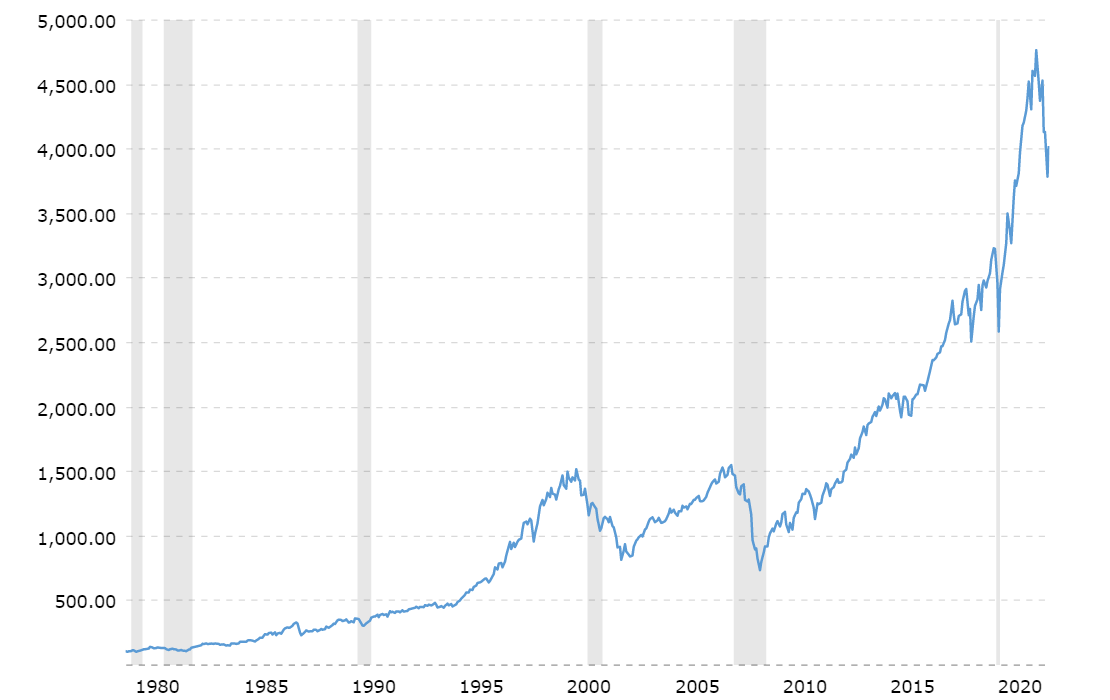

Ultimately, when it comes to recessions and investing, history reminds us that even the toughest economic storms pass.

Just look at the past few recessions going as far back as 1980 (shown in grey) in the chart below. It illustrates how the S&P 500 has rebounded and posted strong long-term gains after an economic recession.

Source: S&P 500 vs. Recession 1980 – 2022

“This is why it’s so important to stay focused on the long-term,” states Lisa in closing. “If you panic and sell now, you may risk missing out on opportunities that could be just around the corner. Yet by remaining invested with a focus on resilience and diversification in your portfolio, you’ll be charting a course for a bright financial future ahead.”

That’s where Educators Financial Group can help.

From pay grids to your pension plan, we have a unique understanding of how your pay structure works during your working years and in retirement. It’s the kind of insight that can truly go the distance when it comes to preparing your portfolio to weather any type of storm.